The Katana V3 Upgrade is LIVE!

Deeper Liquidity, Less Slippage ⚔️

Key Points

Katana V3 is LIVE! Liquidity Providers can now leverage new features and infrastructure to better manage their capital and earn more rewards. Traders can look forward to more efficient execution and lower slippage fees. Note: Katana V2 will still be operational, which means Liquidity Providers can choose to provide liquidity on V2 or V3.

How to provide liquidity and earn rewards: Follow the instructions below to create a Concentrated Liquidity position or set customizable fees on a trading pair. Reduce Impermanent Loss, lower slippage, and more.

Security Audit Complete: Thank you to Code4rena for paving the way for this release through the recent Ronin Security Audit. No high or medium-risk findings were detected.

The Katana V3 Upgrade is LIVE! Create concentrated liquidity positions within custom price ranges. Set customizable fees for individual trading pairs. Leverage new infrastructure like the Smart Order Router for more efficient trade execution. This upgrade brings deeper liquidity and lower slippage fees to Ronin’s DEX – all while supporting the Ronin Treasury. Here’s how it works:

How Katana V3 Benefits Liquidity Providers

Liquidity Providers play a pivotal part in keeping DEXes decentralized, and face a variety of challenges including impermanent loss and slippage. Katana V3 introduces an arsenal of new tools that empower Liquidity Providers to overcome many of these challenges. Here’s how:

Reducing Impermanent Loss through Concentrated Liquidity Positions

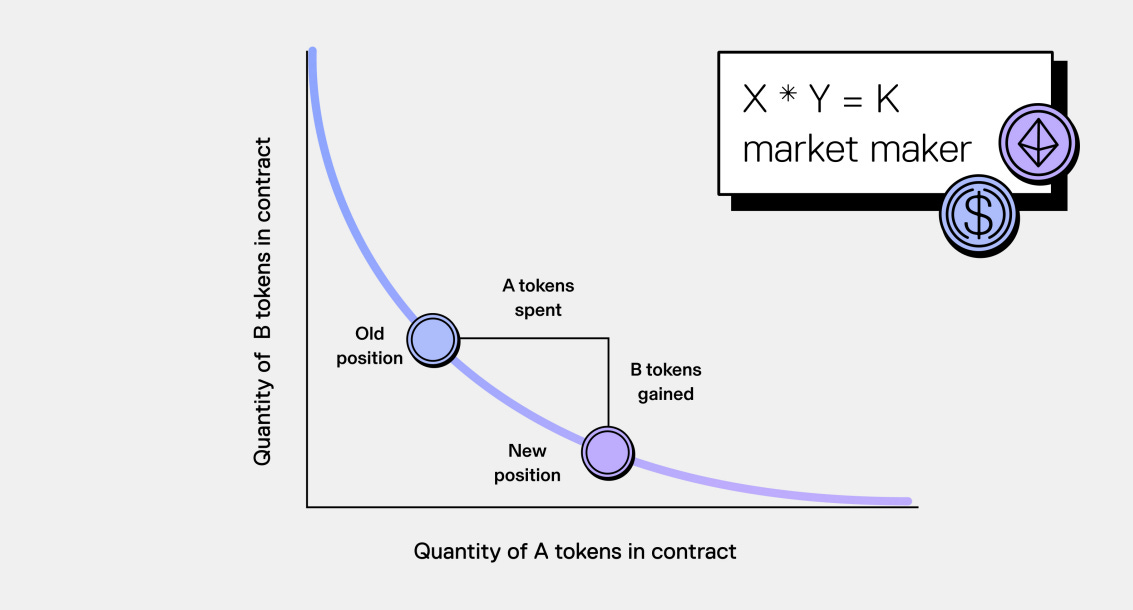

Impermanent Loss is when a Liquidity Provider earns less from providing liquidity than they would have by simply holding the tokens. In general, this happens because a pool balances the ratio of two tokens using the function X * Y = K, where X and Y represent the values of two separate tokens. As X changes, Y rebalances according to the constant K – and vice-versa. Liquidity Providers experience Impermanent Loss when the value of their deposit upon withdrawal is lower than the total spot value of their deposit due to this rebalancing.

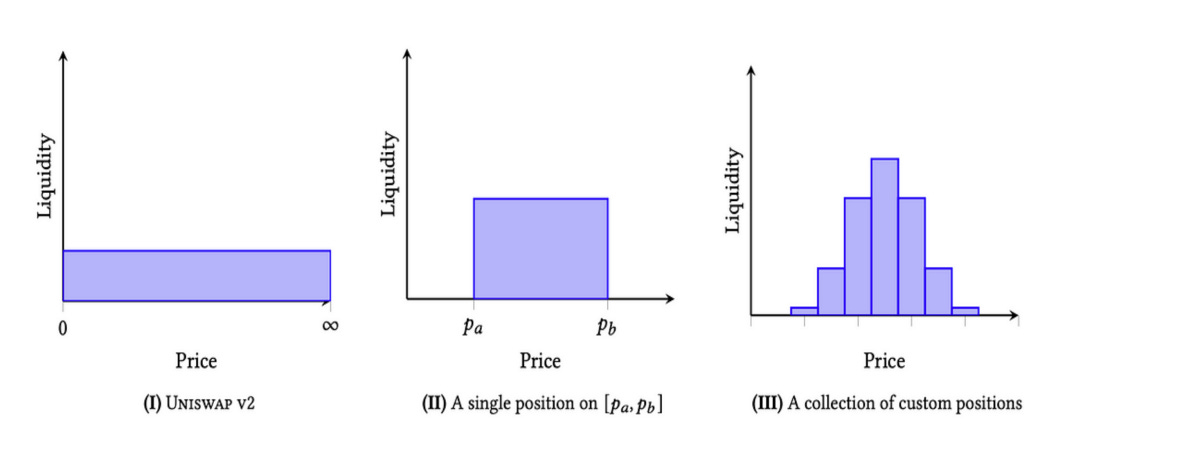

At first, this Constant Product Formula was revolutionary because it unleashed Automated Market Makers (AMMs) and enabled the incentivization of liquidity. However, its initial implementation required available capital at enormous price ranges. In practice, this meant much of Liquidity Providers’ funds sat idle along the extreme ends of the curve – and vulnerable to Impermanent Loss.

Katana V3 introduces Concentrated Liquidity Positions, which empower Liquidity Providers to create focused positions at specific price ranges. This leverages the Constant Product Formula’s elegant simplicity while addressing the issue of idle capital. As a result, Liquidity Providers can earn more rewards for every token.

Lowering Slippage Fees by Increasing Liquidity and Optimizing Trading Options

Anyone who has traded memecoins has heard of slippage or price impact. This is the difference between the expected price of trade and its actual price upon execution. Most often, high slippage fees are the result of low liquidity. The solution? More liquidity, smarter trading options.

Increasing Liquidity

Katana V3’s Concentrated Liquidity Positions encourage deeper liquidity at common price ranges, which reduces the likelihood of slippage fees. New Fee Tiers also enable Liquidity Providers to set rates for individual trading pairs. On one hand, Liquidity Providers can set higher fees for less-correlated pairs – and receive higher compensation as a result. This encourages more liquidity provision in less liquid markets. On the other hand, more stable pairs may warrant lower fees, which can attract higher volume from traders looking for the lowest-fee option. This is the principle that made stableswap AMMs like Curve.fi successful.

Optimizing Trading Options

The Smart Order Router integrates with our updated router smart contract, serving as an aggregator that leverages a broader range of liquidity sources – including Katana V2 and Katana V3 pools. This ensures better swap ratios by optimizing paths across multiple pools, overcoming the limitations of the previous router confined to Katana V2 pools. The feature makes slippage less of a burden, delivering a more efficient trading experience.

How to Provide Liquidity on Katana V3

Step 1: Go to https://app.roninchain.com/swap and connect your Ronin Wallet

Step 2: Select “Liquidity Pool”, then click “Create new pool”.

Step 3: Select the version of Katana you want to use: “Position V3”.

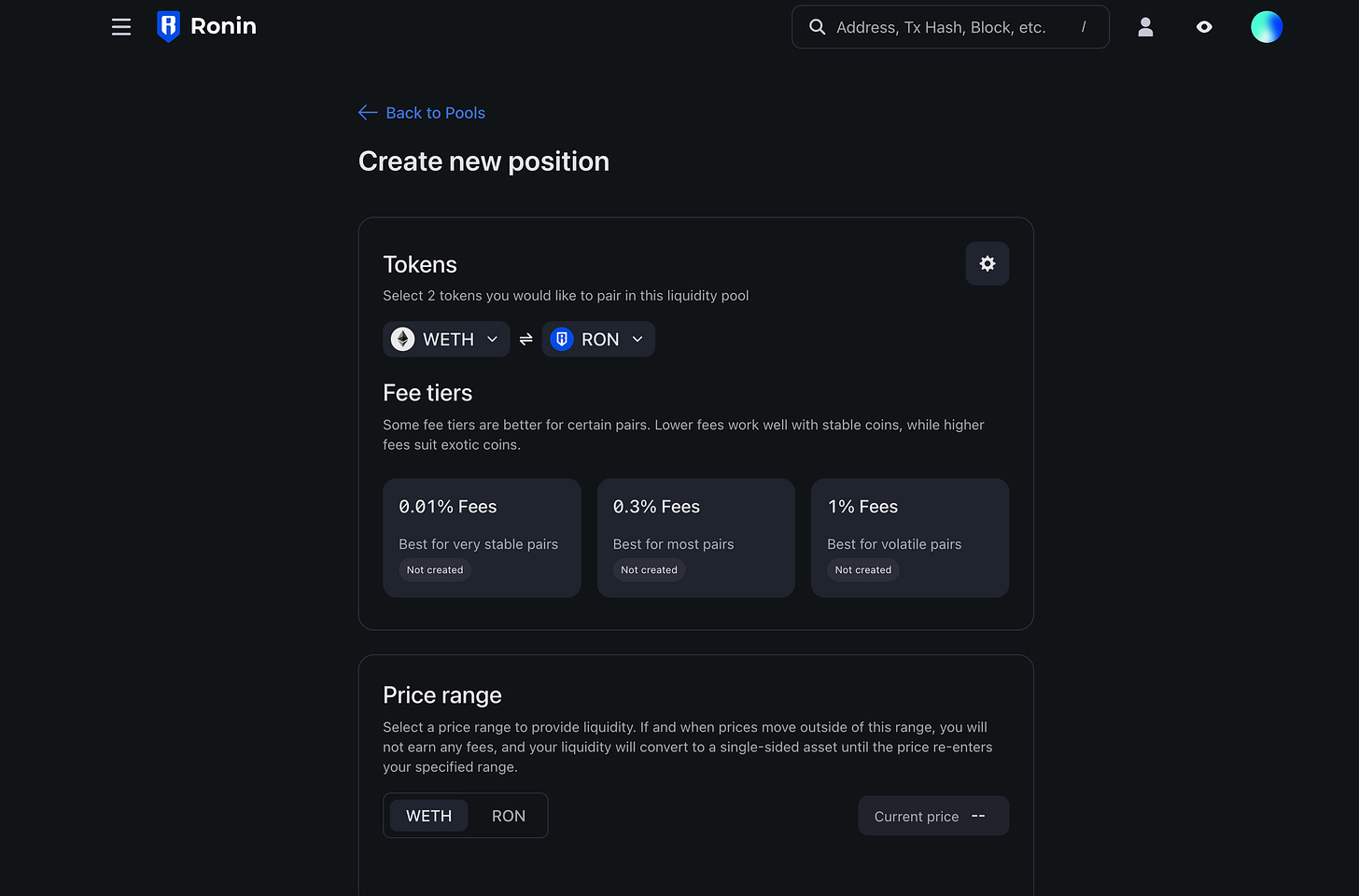

Step 4: Select the tokens you want to pool, then choose the fee tier.

Step 5: Enter the start price and set the price range for your liquidity pool by entering the minimum and maximum prices

Step 6: Enter the amount of tokens you want to contribute to the pool.

Step 7: Click “Confirm” to finalize pool creation

Note: Every Concentrated Liquidity position specifies its own price range, making each one unique relative to regular liquidity positions. As a result, Concentrated Liquidity position tokens are represented as ERC-721 rather than ERC-20.

Final Thoughts

Since 2021, our movement has been on a mission to spread economic freedom to users of the internet. The Katana V3 Upgrade is yet another step in that direction, and reinforces the foundation for a more open Ronin. It also takes inspiration from what Uniswap built in the same year, which you can read about here. Thank you to Code4rena for paving the way for this release through the recent Ronin Security Audit where no high or medium-risk findings were detected. Let’s keep pushing.